Emergence of New Sectors for Youth in India: A Look at India’s Growth and Vision. AI and semiconductor industries are two of the most important and emerging areas in the country.

The general elections of 2024 will be crucial in Indian history. At the India Today Conclave 2024, Prime Minister Narendra Modi made some ambitious pledges despite the fact that India is the world’s fastest expanding economy. During his speech at the Conclave, Prime Minister Modi announced that new industries for the country’s youth would emerge over the following five years. The bold projection can be traced back to the expansion of specific sectors, particularly in the technology field.

In this regard, the two most impactful, up-and-coming sectors are AI and semiconductor industries, both of which are beginning to take shape in the country. However, over the last decade, India has seen exponential growth in a variety of new areas. The country has grown to become the second-largest smartphone market, as well as the second-largest smartphone manufacturer. The production of electronics has also increased significantly. E-commerce is another sector that has grown beyond metropolitan areas, and the electric vehicle boom has helped make EVs a viable alternative to traditional ICE automobiles.

Electronics and Smartphone Manufacturing

Electronics and Smartphone Manufacturing

Electronic goods continue to be one of India’s primary export sectors, with a 14.41% growth in December to $2.62 billion from $2.29 billion in December 2022. The milestone for December 2023 sets a new monthly high for electronics exports for the current fiscal year.

According to the India Cellular and Electronics Association (ICEA), the sector set high goals a decade ago, which it has not only reached but exceeded. The group claims that the industry generated 2.45 billion mobile phones in the last decade. The expected value of these devices in FY24 is Rs 4.1 lakh crore, up from Rs 18,900 crore a decade earlier.

The sector set a 10-year output target of Rs 20 lakh crore, which it has nearly met with a total of Rs 19.45 lakh crore.

Furthermore, India’s mobile phones have entered the global market. Over the past decade, mobile phone shipments have totaled an estimated Rs 3.22 lakh crore. This makes mobile phones India’s fifth-largest export commodity. During the current fiscal year, it is estimated that 30% of production will be exported. This demonstrates the quality and competitiveness of Indian-made mobile phones.

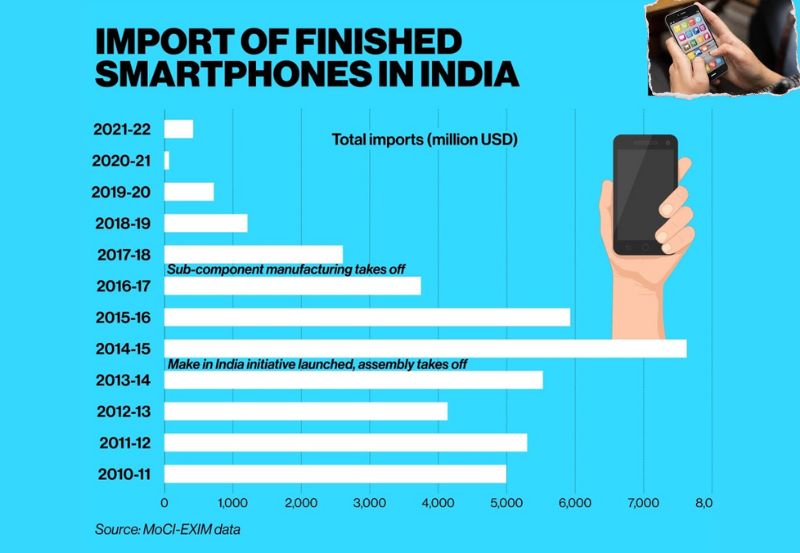

Imports of finished smartphones in India have also declined sharply since 2015, with the lowest imports in 2020-21.

Challenges

Despite rising labor expenses, China is more cost-effective than most of its major global competitors. Despite its rapid growth, India confronts numerous hurdles in becoming a leading manufacturing powerhouse, particularly in compared to its Chinese neighbor. The Chinese government claims to have accounted for approximately 30% of total world industrial output in 2021. India can drive growth by upskilling its workforce and improving infrastructure. The government intends to raise output from 17% of GDP in 2023 to 25% of GDP as early as 2025.

Increased competition from other markets might also hinder manufacturing expansion. According to a BCG analysis, more than 90% of North American businesses questioned had shifted some manufacturing from China in the last five years, with a similar percentage planning to do so in the next five years. Apart from India, other popular locations include Mexico, Southeast Asia, Turkey, and Morocco.

EV manufacturing

The EV sector was in its early stages a decade ago, but it has grown exponentially in the second half of the last decade. FAME I policies played a critical role in the segment’s expansion. Indian EV producers played a critical role in this regard. To provide some background, there were 2,390 EVs sold in 2014. In February of this year, the average number of units sold per day was more than double. According to the EV Ready India dashboard, 1,46,423 units were sold in February. In 2023, India sold more over 1.5 million EVs, which is almost 50% higher than sales in 2022.

According to Maxson Lewis, Founder and CEO of Magenta Mobility, “India’s journey to embrace electric vehicles reflects a remarkable evolution, shifting from ‘What is an EV?’ to ‘Why not an EV?'” This shift has been pushed by regulatory milestones such as the de-licensing of charging stations, the FAME 1 subsidy, and the required switch to electric buses for public transportation.

He further stated, “increase is visible throughout segments, with L3 Rickshaws exhibiting 100% increase since 2014 and large peaks in the 2W and 3W sectors by 2022-2023. The L5 freight has a 60% electric share, indicating a push toward sustainability. While the EV space initially experienced little growth, current data from the Vahan dashboard show a promising 154% year-over-year growth in FY 2022-23. This trajectory suggests a bright future.

While India is likely to continue to see growth in the EV market, problems such as over-reliance on government subsidies, higher prices in contrast to ICE vehicles, and limited charging infrastructure may slow progress.

The rise of e-commerce

The online retail business in India is expanding rapidly. In the fiscal year 2022-23, the Government’s online marketplace (GeM) generated its highest-ever sales of $2011 billion. According to Invest India, since its inception, GeM has sold over 4.5 lakh crore of items and saved over Rs 40,000 crore.

As of March 2023, India has over 880 million internet users and 1172 million phone subscribers. The increase in online purchasing is due to more individuals utilizing smartphones, more money to spend, and low-cost internet. India has the world’s second-largest internet user base, with over 800 million people online. In 2022, there were 125.94 lakh crore transactions performed over UPI, which is likely to increase further.

Invest India further claims that e-commerce is no longer limited to major cities. Shopping online has become popular in almost every part of India. More than half of all internet orders come from small towns and cities. When it comes to online shopping, these smaller towns are swiftly catching up with the larger ones.

The average amount spent in smaller towns is only marginally less than in bigger cities.

India spends the most of its money on gadgets and clothing online, accounting for nearly 70% of the total market. Other rapidly expanding fields include online learning, local delivery services, and food delivery.

India aims to have 1 billion internet users by 2025, and the e-commerce business is expected to increase by 18% per year through 2025. The government also projects that by 2030, the nation would have 200–300 million online buyers, making it the second-largest online consumer base in the world.